All Categories

Featured

Table of Contents

Guaranteed global life, like entire life, does not end as long as you purchase a plan that covers the rest of your life (final expense insurance commissions). You can purchase a policy that will cover you to age 121 for optimal defense, or to age 100, or to a younger age if you're trying to save money and do not need coverage after, claim, age 90

Anything. An insured may have intended that it be made use of to spend for points like a funeral service, flowers, medical expenses, or assisted living facility prices. The money will certainly belong to the recipient, who can opt to use it for something else, such as credit scores card financial obligation or a nest egg.

A lot of internet sites supplying it have calculators that can give you an idea of cost. For illustratory objectives, a 65 year-old female looking for a $10,000 face quantity and no waiting period might pay concerning $41 each month. For an assured acceptance plan, they 'd pay $51. A 65 year-old male looking for a $10,000 face amount and no waiting duration may pay about $54 monthly, and $66 for guaranteed approval. select advisor life insurance.

Heritage Burial Insurance

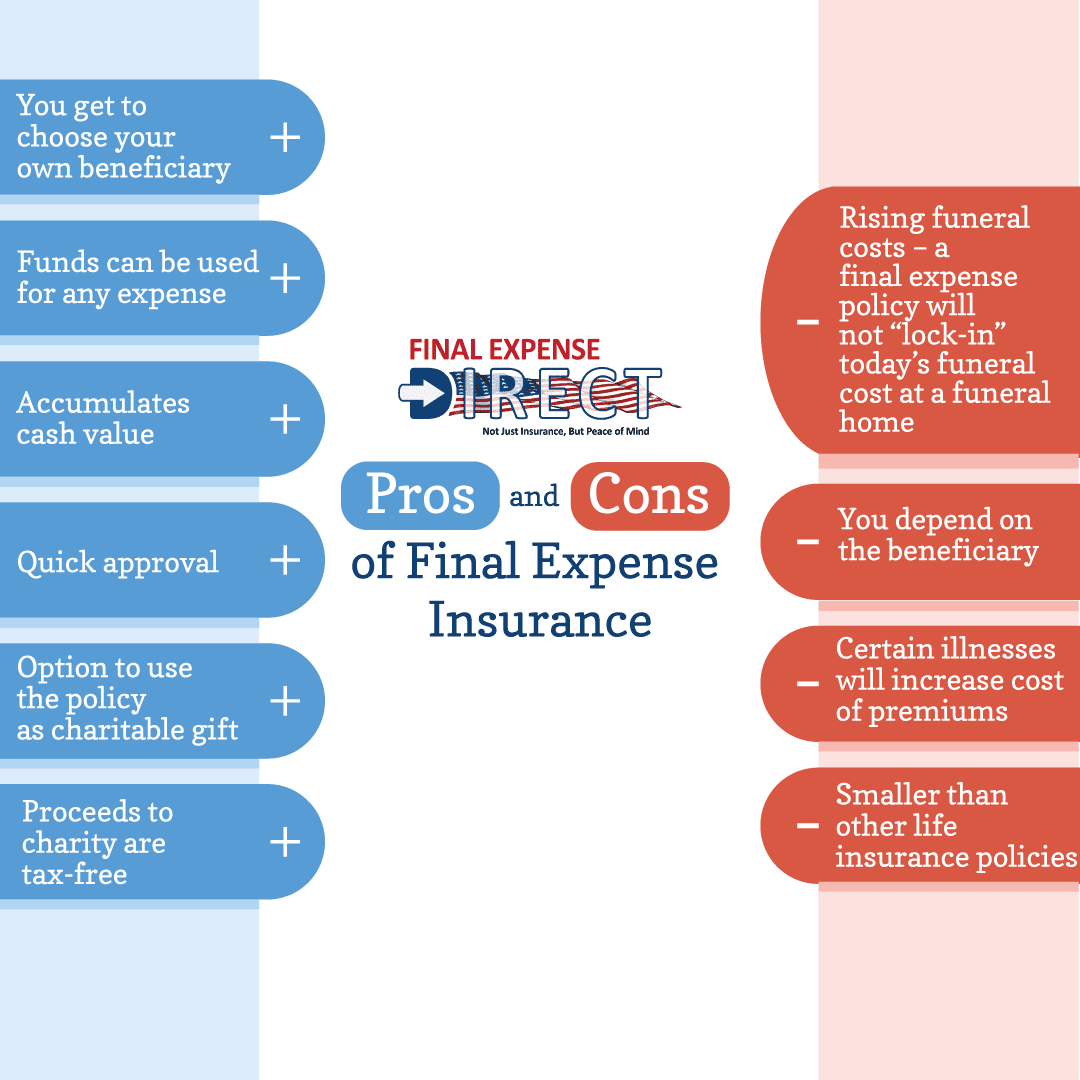

If you have enough cash alloted to cover the expenditures that should be fulfilled after you die, after that you do not need it. Lots of people are uninformed of the high (and growing) price of funeral services. Or that a health center may provide them with huge, unforeseen costs. If you do not have money for these and various other associated expenditures, or normal insurance coverage that might cover help them, final expense insurance policy could be an actual advantage to your household.

It can be utilized to spend for the numerous, conventional solutions they want to have, such as a funeral or memorial service. Financial cost insurance policy is easy to qualify for and inexpensive - final expenses insurance quotes. Insurance coverage amounts array from $2,000 up to $35,000. It isn't a big amount but the advantage can be a godsend for relative without the monetary wherewithal to satisfy the costs linked with your passing.

While numerous life insurance products need a medical examination, last cost insurance coverage does not. When using for final expense insurance coverage, all you have to do is respond to several questions about your health and wellness.

Final Expense Insurance Training

If you're older and not in the best health and wellness, you might see greater costs for last expenditure insurance policy - cost of funeral plan. Before you dedicate to a last expense insurance coverage policy, think about these factors: Are you just looking to cover your funeral and burial expenditures? If so, final expenditure insurance policy is likely a great fit.

If you 'd like sufficient coverage without breaking the financial institution, last expenditure insurance may be worthwhile. If you're not in excellent health and wellness, you might wish to miss the medical examination to obtain life insurance policy coverage. In this case, it may be smart to think about last expense insurance. Last expense insurance policy can be a wonderful method to assist secure your loved ones with a tiny payout upon your death.

Last costs are the expenditures your family members pays for your interment or cremation, and for various other points you might want during that time, like a gathering to commemorate your life. Although thinking of last costs can be hard, recognizing what they cost and making certain you have a life insurance coverage policy large enough to cover them can aid save your family an expenditure they could not have the ability to afford

One choice is Funeral Preplanning Insurance which enables you pick funeral products and solutions, and fund them with the acquisition of an insurance coverage. An additional choice is Final Cost Insurance Coverage. This type of insurance gives funds straight to your recipient to help spend for funeral and various other costs. The quantity of your last costs depends upon several points, including where you reside in the USA and what kind of last setups you want.

Funeral Cover Prices

It is projected that in 2023, 34.5 percent of family members will certainly select burial and a greater percentage of families, 60.5 percent, will select cremation1 (end of life expense insurance). It's approximated that by 2045 81.4 percent of family members will choose cremation2. One reason cremation is ending up being much more popular is that can be less costly than interment

Depending on what your or your family desire, points like interment stories, grave pens or headstones, and caskets can increase the cost. There may additionally be expenses in enhancement to the ones particularly for burial or cremation. They could consist of: Treatment the expense of traveling for family and loved ones so they can attend a solution Catered dishes and other costs for a celebration of your life after the service Purchase of unique outfits for the service When you have a good idea what your final expenditures will be, you can assist prepare for them with the best insurance coverage.

They are usually provided to candidates with one or even more health and wellness conditions or if the applicant is taking certain prescriptions. funeral insurance over 50. If the insured passes during this period, the recipient will usually get all of the costs paid right into the plan plus a tiny additional portion. An additional last cost option used by some life insurance policy companies are 10-year or 20-year strategies that give applicants the option of paying their policy in complete within a specific timespan

Life Insurance For Funeral Expenses

One of the most crucial point you can do is answer inquiries truthfully when getting end-of-life insurance coverage. Anything you keep or conceal can cause your advantage to be refuted when your family members requires it most (cheap family funeral cover). Some individuals assume that because the majority of final expenditure policies don't require a medical exam they can lie regarding their health and wellness and the insurer will never ever understand

Share your final wishes with them too (what blossoms you might desire, what passages you desire reviewed, songs you want played, etc). Documenting these ahead of time will certainly save your liked ones a lot of stress and will certainly avoid them from trying to presume what you wanted. Funeral prices are increasing regularly and your wellness might alter instantly as you age.

The key recipient obtains 100% of the death advantage when the insured dies. If the key recipient passes prior to the guaranteed, the contingent obtains the advantage.

Burial Insurance Cost

It is very important to periodically review your recipient details to make certain it's current. Constantly notify your life insurance policy company of any change of address or telephone number so they can upgrade their documents. Many states allow you to pre-pay for your funeral service. Before you pre-pay, examine to see just how the cash will certainly be held.

The fatality benefit is paid to the primary recipient once the insurance claim is approved. It depends on the insurance coverage company.

If you do any kind of type of funeral planning ahead of time, you can record your final want your primary beneficiary and demonstrate how much of the policy advantage you intend to go towards last setups. best final expense policies. The procedure is usually the very same at every age. Many insurance policy companies require a specific be at the very least one month of age to obtain life insurance coverage

Some firms can take weeks or months to pay the plan advantage. Your insurance policy price depends on your health, age, sex, and just how much insurance coverage you're taking out.

Latest Posts

Buy Funeral Policy

Silver Care Life Final Expense Plan

Funeral Insurance Comparison